If Brexit happens, the UK will not be in a strong position to face global challenges. Trade openness is now much lower than that of the EU as a whole and the manufacturing sector has been neglected. The UK is not an innovation leader and its current strong involvement in EU R&D programmes will inevitably be diminished as a result of Brexit. Negotiating a new trade relationship with the EU (let alone other countries) will be difficult, both because of specific political issues and because trade negotiations are more complicated today than they used to be.

This uncertainty will also impact investment, where UK success up to now will be undermined. The UK financial sector is very important in the UK but has been losing competitiveness. Brexit would mean that it no longer had any voice in EU decision-making. Divergent regulation would further complicate trade negotiations, while the administrative burden on businesses will be complex and hard to measure but a further dampener on trade.

The economic impact of Brexit is generally seen to be negative for the UK and for the rest of the EU. But there will be other effects also: the EU will be driven to increased political coherence, with more rapid consensus possible on a wider range of issues, including budgets, taxation, social policy and infrastructure development. The centre of gravity of the EU will shift to the east, and external policy will reflect this. Increased cohesion and faster decision-making are likely to have positive aspects, and the EU financial sector and the euro may benefit.

According to the bookmakers, the likelihood of Brexit is not very great, but opinion polls point to a closer finish. This is in spite of the fact that everyone else in the world (with the possible exception of Donald Trump) is sure that this would be a bad thing. In any case the prospect of Brexit raises a number of interesting questions for the future of the UK and the EU. Economic and business issues cannot be fully separated from the political, and the kinds of policies that will be needed in Europe in future will also change if the UK leaves.

Comparing the economic structures of the UK and the EU-28 as a whole is instructive with respect to some key policy issues. Both in 1970 and in 2014, the UK gave priority to consumption, with the share of private consumption in GDP above that in the EU as a whole. Correspondingly, investment in the form of gross fixed capital formation has been less important in the UK, with the share in 2014 at 16.9 per cent compared to the EU average of 19.4 per cent. There are even more striking differences in the sectoral breakdown of value added, particularly as regards manufacturing. In advanced economies, the relative decline of manufacturing is the usual experience, with the rise in the importance and increased complexity of the services sector, but it is notable that in the UK case the manufacturing sector declined from 27.0 to 10.6 per cent between 1970 and 2014, while in the EU as a whole the decline was from 28.0 per cent to 15.5 per cent of total value added. This remarkable decline in the manufacturing sector is often attributed to the growth of financial and other services in the UK, but it can also be ascribed to a failure to improve the technological content of manufacturing so that its export capabilities can be ensured.

In fact, the importance of trade to GDP suggests that the challenges of international markets are not being met. The trade openness (exports plus imports of goods and services as a percentage of GDP) of the UK was 41.8 per cent in 1970 and by 2014 was 58.6 per cent. The openness of the EU as a whole was similar in 1970 but by 2014 had far exceeded that of the UK at 83.4 per cent. Openness, including participation in global value chains, can give important strengths to an economy in terms of diversification of sources and markets and also in terms of technological diffusion.

Science, technology and innovation

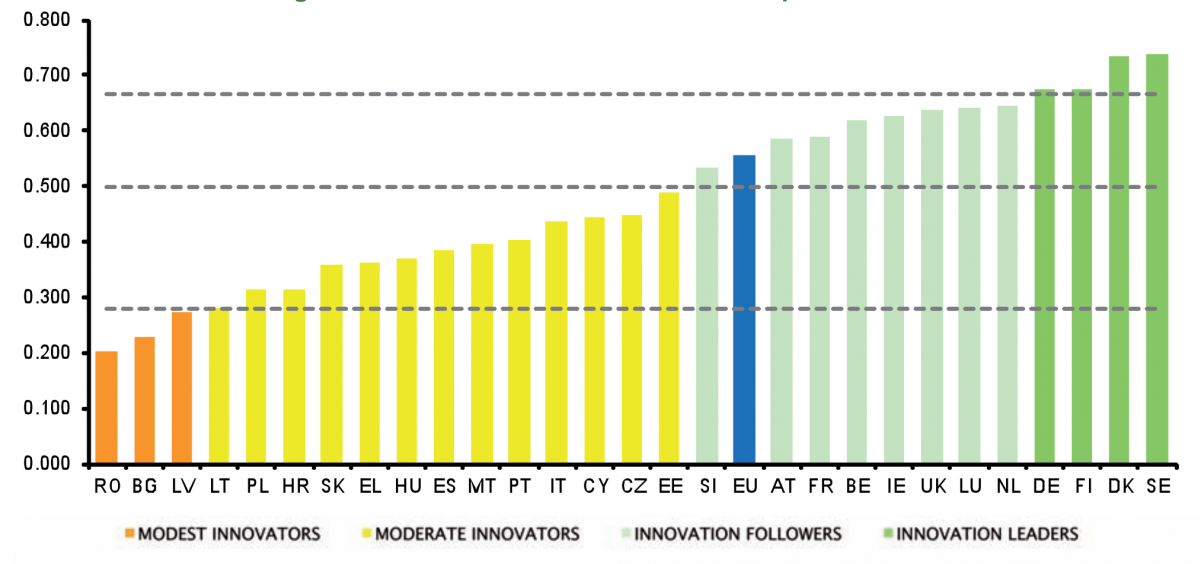

The future of the UK and the EU in the years to come will be determined at least partly by technological change and by whether innovation plays a strong role in the economy. The UK has acknowledged excellence in many fields of science and technology and its famous universities regularly feature in the lists of the world’s top ten. Nevertheless, innovation is not as strongly embedded in the economy as it is in some other countries, and the EU’s ranking of countries, the Innovation Union Scoreboard 2015, places the UK in the second tier, the so-called “innovation followers”1.

The EU programmes on science technology and innovation have been for many years an important part of policy, with improved competitiveness the principal goal. FP7 was the most recent completed programme and Horizon 2020 is the current one. Total Horizon 2020 funding, including Euratom, is over 70 billion. Funds are allocated on the basis of proposals made from universities, businesses, research institutes and government bodies. Collaborative proposals form the main mechanism, with at least three organisations from three EU members required. Other non-EU countries may also be included. In these cases there may be some EU funding of the non-EU country’s research activity, but not if the country is “industrialised”.

Researchers in the UK are certainly interested in these programmes. For Horizon 2020, there were over 14,000 applications from the UK. This was the biggest number in the EU and about one-eighth of the total. The UK has also done well in these programmes. Its share of the funding awarded in Horizon 2020 is nearly 15 per cent, in second position after Germany. Brexit therefore puts at risk much of this success. Without continued EU membership, there is a clear risk for the UK that its competitiveness in this regard will diminish. Firstly, it will lose access to EU funding for R&D. Secondly, it will lose a central voice in the direction of funding and other technology-related policy initiatives. And finally, its individual research institutions may move to more subsidiary roles if they are included in the EU projects. This will represent a loss also to the EU: the UK’s ideas, scientific resources, invention and innovation are valuable for the EU as a whole.

Trade issues

Given the issues between the UK and the EU that are being emphasised by Brexit supporters, it seems unlikely that, after Brexit, the UK would join the EEA, where it would retain access to the single market. The price of this (acceptance of all regulations, a financial contribution, and the continuation of the free movement of labour) would be unacceptable to Brexit supporters. Accordingly the assumption must be that post-exit discussions would centre on a new trade agreement. The Vote Leave campaign spokesman Michael Gove (who is also the Justice Secretary) has said the UK would be part of the European free trade zone with access to the European single market but "free from EU regulation which costs us billions of pounds a year"2. This seems unachievable, as well as being very unclear.

The starting point for many discussions of Brexit, at least in the UK, has been the trade relationships between the two. Brexit supporters point to the fact that the UK market for other EU products is bigger than vice versa, and so "they need us more than we need them": a renegotiation of trade relations between the two sides will be straightforward. But this is not the case. With the decline of the WTO process, international trade negotiations have become a lot more complicated because what for simplicity sake we can call bilateral negotiations have to take account not only of the interests directly at stake, but also of the effects of these changes on other countries. An improvement in trade relations between country A and country B can have knock-on effects on the relations between these two countries and also on other countries not part of these negotiations. This means that, within a context where a number of negotiations are going on in different parts of the world (which is very much the case today), assessment of the impact becomes a lot more complicated. In any case, with the growth of global value chains where products are produced in one country from materials from another to be exported to a third mean, complex questions arise of the value-added created in each country and the appropriate tariff to apply.

Also, regulatory issues are now more important than tariffs, but the assessment and negotiation of them is more fraught. Regulation is discussed further below, but here it’s important to stress that regulation a key issue in trade negotiations. Entering a market means accepting the regulations in place, and adapting the product or the service to fit those parameters. But this has costs for exporters and reduces their competitiveness. What if the regulations are unnecessary or too burdensome? What if they’re in place in order to protect the domestic producer? These sorts of issues mean that the acceptability and the mutual recognition of regulations are now a key feature of trade negotiations.

The future of trade between the UK and the EU has to take that complexity into account. The negotiations will not be easy and may well not be concluded within the proposed two-year period. Add to this the fact that the UK would have to negotiate new agreements with third countries with whom the EU had negotiated agreements, and complexity and resource constraints are intensified. The processes are further complicated by the fact that although the European Commission has exclusive competence in the negotiation of trade and investment agreements, it also has to keep member states informed and to achieve agreements that will ultimately be endorsed by the national parliaments: delays and uncertainty are very likely.

Assessment of the economic impact have focused on the trade and investment impact. Two notable and detailed analyses at international level are those from the OECD3 and from IFO4. Both point to losses on both sides as a consequence of Brexit. The OECD notes that it is highly unlikely that the current trading arrangements that the UK has with the EU, and the countries with which the EU has separate agreements, would have been successfully replaced by the end of 2018, and the IFO study stresses the importance of speedy negotiations. A further difficulty is that, while economic analyses of trade agreements can be quite precise about the effects of tariffs and tariff reductions in the short-term, little is known about the effects of regulatory change. As noted above, tariffs now account for a relatively small part of the total barriers to international trade within the developed world, and the effects of post-Brexit regulatory change cannot be confidently determined.

Investment

It is harder again to look at the investment picture. The difficulty in this case is that investment statistics do not necessarily capture the potential transformation of economic structures caused by the right kind of foreign direct investment. If a Russian oligarch buys a house in London or a Thai investor buys an English football club, this adds to the total of inward FDI for the UK. But it does not necessarily provide the boost to the economy that would be provided by the establishment or expansion of a high-tech company that creates skilled employment and forges research links with neighbouring universities.

The investment effects of Brexit are important due to existing under-investment in the UK economy as a whole. Greenfield and expansionary foreign direct investment of the kind that will continue to give a boost to the UK economy5 will certainly be impacted by doubts on UK access to the single market. Foreign firms do not typically manufacture in the UK in order to primarily serve the UK domestic market but rather to serve a potential 500 million consumers in the single European market. Some diminution of flows, which in the past have kept the UK high up in the lists of FDI performance of this kind, will certainly take place.

Financial sector

The financial services industry in the UK is a strong sector, and it is the focus of much of the argument concerning the UK’s membership in the EU. The degree of financial regulation increasingly sought by the EU as a whole is resisted by the UK, because it is said to be a threat to the financial services industry and in particular to the City of London, where most of the sector is located. Those arguing for Brexit are inclined to suggest that the sector would thrive if the UK were outside the EU, where burdensome regulation would no longer apply6.

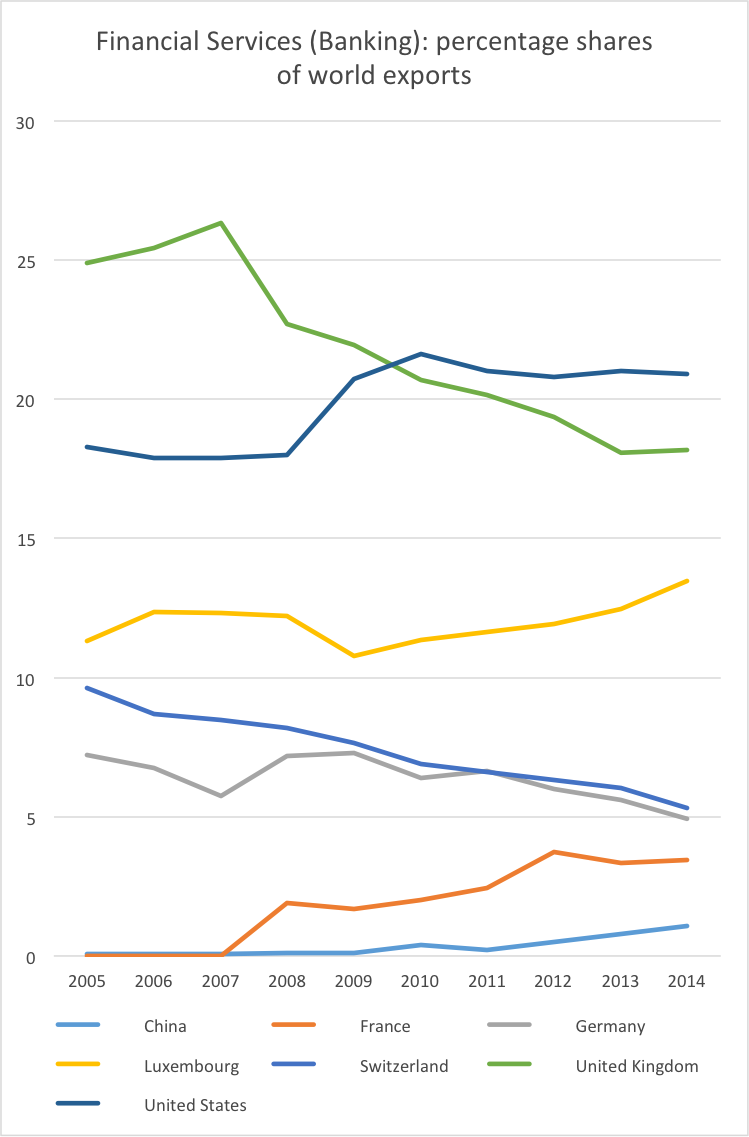

Let's look at the figures. UNCTAD data on services exports certainly confirms the extraordinary strength of the U.K.'s financial services sector. The data covers “financial services” and “insurance and pension services”: in other words the first group is predominantly banking. In 2005 this sector in the UK accounted for 25 per cent of world exports of financial services and no less than 30 per cent of insurance and pension services worldwide. In 2005 it was the largest by far of all the countries, with the United States in second place in both categories, at 18 per cent and 11 per cent. But that was then. The years since 2005 have seen a weakening of the UK's relative position worldwide in these sectors. In financial services, the United States has now overtaken the UK at over 21 per cent while the UK share has fallen to 18 per cent. Similarly in insurance and pension services there has been a decline also, although not as marked, to 26 per cent.

The downward trends in the UK’s share of world financial services and world insurance and fund management exports point to a loss of competitiveness. If, as we assume, the UK is excluded from the single market as a result of Brexit, or if its insurance and pension services as well as hedge fund activity are restricted in their scope for expanding business in Europe, then the outlook is not very good. The notion that removal of EU regulations would encourage the growth of UK sectors has to be seen in the context of what has happened in other European countries. If EU regulation is so restrictive how has Luxembourg increased its share of world financial services from 11 to 13 per cent between 2005 and 2014? How has Germany managed to increase its share of insurance and pension services from 5 to 7 per cent? How has France increased its global share in both sub-sectors, admittedly from a smaller base?

There are also more fundamental and disruptive trends at work in these industries that will imperil all of the existing players. They include technological change, the growth of peer-to-peer lending and the sharing economy, new payment systems, and the development of alternative currencies such as Bitcoin. Finally there is the rise of China, whose services enterprises have begun, slowly but surely, to increase their share of world markets, starting from a low base but with steady increases.

Brexit would certainly remove a powerful advocate for London's financial sector from European decision-making. The implicit UK brake on the growth of financial centres in France, Germany, and elsewhere within the EU will be gone. The long held view in Frankfurt and elsewhere that euro markets should be headquartered within the Eurozone will have no internal EU opponents.

Some UK Overseas Territories and Crown Dependencies also have considerable economic activity as offshore financial centres. Quite apart from questions of legality or tax justice, there is increased concern about the offshore system in general. It is not so much a response to popular concern about tax havens that drives the activity at G20 and OECD levels to increase regulation at an international level, but rather stability concerns: the real issue is the difficulty of maintaining an overview of the international financial sector and its obligations and vulnerabilities. The networks of offshore financial services are contributing to this stability concern. Brexit would mean that the UK voice in how its offshore centres would be regulated in the future would be weakened.

Regulatory and administrative issues

The UK has been a pioneer in some areas of regulatory reform and its influence has been significant, not just in Europe. It has provided much of the economic and legal basis for regulation of the so-called network industries, such as electricity, water, and telecommunications. The role of the UK in assessing the issues and determining appropriate policies and pricing models was very important for many other countries, in Europe and elsewhere, as they proceeded to liberalise their markets. With respect to other industries however, there is some divergence: the UK tends to follow a less prescriptive approach than its EU partners.

For example, the UK recently announced plans to abolish government regulation of the poultry production sector as regards animal welfare, and to allow the sector to regulate itself in this area. A storm of protest caused a government change of heart on the issue but it remains indicative of the underlying approach preferred in the UK7. “Principles-based regulation” is now to be developed for the retail energy market in the UK, in spite of its association with the financial crisis8. If Brexit happens, we can expect significant divergence in regulatory approaches between the UK and the EU. It is more likely, for instance, that the UK would relax its regulation of genetically modified organisms (GMOs) than is the case in the EU9.

The administrative burden of Brexit has been touched upon above. There would be additional work especially in the area of customs and trade facilitation generally in order to reflect the fact that the UK was no longer part of the Single Market. Costs would increase for all transactions. It is true that advances in information technology would mean that these costs could be contained, and automated recording of transactions and the movement of goods continues to improve in any case. But costs there would be. It would require changes on both sides to the wide range of commercial IT systems, including ordering systems, sales and marketing strategies, and in logistics, warehousing and in other areas. The assessment of goods as to whether they met required standards would also be a further cost. Labour mobility would be affected; the recognition of qualifications which is in place in the EU at present could be disrupted, and this would impact UK and EU residents moving from one to the other, with possible further difficulties in access to social security, health systems and pension entitlements.

Future development of the EU

Lastly we consider the political impact of Brexit on the EU itself. The departure of the UK would possibly encourage one or two other member states to think about leaving but on balance there does not seem to be sufficient momentum at this stage, even in the Czech Republic, for such a step. The more likely effect would be that it would encourage closer coordination and increase solidarity between the remaining member states. "Ever closer union" would be back on the agenda, in spite of the assurances that were given to the UK Prime Minister at the EU summit. This would increase emphasis on an enlarged EU budget, on tax harmonisation, and on cohesion-strengthening initiatives in social policy and in strategic infrastructure development. In monetary terms, the likelihood is that there would be increased pressure on the remaining non-euro countries to move ahead to membership of the euro, with the merger of Ecofin and the Eurogroup becoming more likely.

The other effect of the UK departure would be to shift the centre of gravity both in population terms and in strategic terms to the east. This makes it more likely in the future that Turkey would be admitted as a member, with pressure emerging from the need for increased cooperation already underlined by the migrant crisis. A closer relationship between the EU and the Mediterranean countries in the Middle East and North Africa would follow. The sense that the EU will be more cohesive in the future and more likely to agree on banking sector reform could encourage a greater significance for the euro and increased international confidence in its future.

In the longer term the departure of the UK from the EU would also mean that the remaining countries are much more homogenous in their approach to legal matters. With the vast majority having some kind of civil law, rather than common law, this may in the future lead to the development of a European civil code, a project that has been underway for some time but with the departure of the UK could well receive fresh impetus. This would provide for a further improvement in the operation of the European single market and also enable citizens of the EU to work and live in other member states more easily than at present. It might even have additional effects in reducing the role of the UK as a point for dispute resolution, with negative impacts on the legal services sector in the UK as a consequence.

It is not all good news for the EU. Firstly there is the immediate negative effect in economic terms. Then there is the loss of human resources in the widest sense, and reduced cooperation and cross-fertilisation of ideas that characterise much of the work of the EU at a practical level. In geopolitical terms Brexit contributes to increased uncertainty. It reduces the economic and political weight of the EU in international terms, not only in trade and investment negotiations but also in development cooperation. Rationalisation of the composition of the UN Security Council may be further delayed.

What will be the cumulative effect of changes in investment patterns, differences in regulation, reduced technological cooperation and some of the other changes discussed above? In the longer term they will outweigh the short-term changes in trade, because they will have resulted in shifting corporate strategies to address diverging markets, with the UK and the EU going their separate ways. It is likely that those strategies will be more focused on a large area than a smaller one, one that is more concerned with technological development than with the growth of the financial sector, and one that has more power to affect regulation at the international level than another. If Brexit happens, everyone loses. Initially, anyway. In the longer term, the UK loses more than does the EU, and the EU, without its most sceptical member, may have more of an opportunity to work effectively and to shape the world in which it will find itself.